How to hide W-4 fields for state specific forms in infotype 0210?Īpril 30th – The following SAP Note has been released:.May 18th – The following question has been added to the FAQ section

#Change w 4 form professional

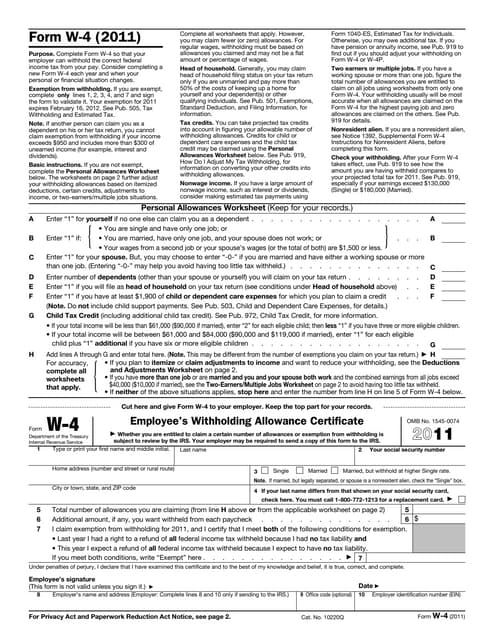

The reader should contact his or her Ernst & Young LLP or other tax professional prior to taking any action based upon this information. The reader also is cautioned that this material may not be applicable to, or suitable for, the reader's specific circumstances or needs, and may require consideration of non-tax and other tax factors if any action is to be contemplated. The information contained herein is general in nature and is not intended, and should not be construed, as legal, accounting or tax advice or opinion provided by Ernst & Young LLP to the reader. Kenneth Hausser ( Debera Salam ( Kristie Lowery ( Payroll News Flash.Workforce Tax Services - Employment Tax Advisory Services Once released, it may be found here.įor more information on California payroll taxes, see the EDD website.įor additional information concerning this Alert, please contact: The 2020 Publication DE 44, California Employer’s Guide is not yet available. Employers should continue to calculate withholding based on previously submitted Forms DE 4.Īs we reported, the EDD issued the wage-bracket and percentage method withholding tables for calendar year 2020 to its website.(EY Payroll Newsflash Vol. If a new employee does not submit state DE 4, the employer must withhold state income tax as if the employee were single and claiming zero withholding allowances.Ĭurrent employees who submitted a Form W-4 before 2020 are not required to submit a new form if they have no changes to their withholding allowances. New hires and existing employees making changes to their withholdings must submit both the Form W-4 and the Form DE 4. The 2020 Form DE 4, Employee’s Withholding Allowance Certificate, has not yet been posted to the EDD website. The California Employment Development Department (EDD) posted information regarding this issue to its website. Previously, an employer could mandate use of state Form DE 4 only when employees wished to use additional allowances for estimated deductions to reduce the amount of wages subject to state withholding. California employees are now required to use state Form DE 4 in addition to federal Form W-4Ĭalifornia employees are now required to submit both a federal Form W-4, Employee’s Withholding Certificate, and state Form DE 4, Employee’s Withholding Allowance Certificate, when beginning new employment or changing their state withholding allowances.

0 kommentar(er)

0 kommentar(er)